E-Stamp Paper vs Traditional Stamp Paper: The Practical 2026 Guide

Understand the difference between traditional stamp and e-Stamp paper in India. Learn risks, legal validity, and why e-Stamping is safer in 2026.E-Stamp or Physical Stamp? Find Out Which Saves You More

Both e-stamps and traditional stamp papers are legally valid, but e-stamps are faster and more secure.

Key Differences:

- Cost: E-stamps have transparent pricing (duty + small fee), while traditional stamps may include vendor premiums.

- Availability: E-stamps are instant online; traditional papers depend on physical stock and bank hours.

- Security: E-stamps use QR codes and UINs to prevent fraud; traditional papers are easier to counterfeit.

- Convenience: Digital generation is better than travel for traditional stamp.

Choosing between traditional stamp paper and e-Stamp paper directly affects the legal validity and enforceability of your agreement. A wrong choice can weaken your contract, even if all terms are properly written and signed.

For example, imagine you sign a business contract on traditional stamp paper. It looks official, and both parties proceed with confidence. Six months later, a payment dispute arises. You approach the court to enforce your agreement, only to discover that the stamp paper attached to your contract was a reused photocopy, or worse, a counterfeit. As a result, your agreement loses its legal strength and becomes difficult to enforce.

This is why understanding the risks of traditional stamp paper and the benefits of e-Stamping is essential before signing any important document.

Risks of Traditional Stamp & Why E-Stamp is Safer in 2026?

Traditional stamp papers work like physical cash. Once printed, they can be:

- Stolen or misplaced

- Backdated or altered

- Photocopied and reused

- Forged or counterfeited

Even genuine purchases are not always safe.

A small clerical error such as a misspelled name, incorrect amount, or wrong purpose can invalidate the stamp. This means wasted money, delayed agreements, and legal complications.

Why E-Stamping Was Introduced

To eliminate these risks, the Government of India introduced e-Stamping.

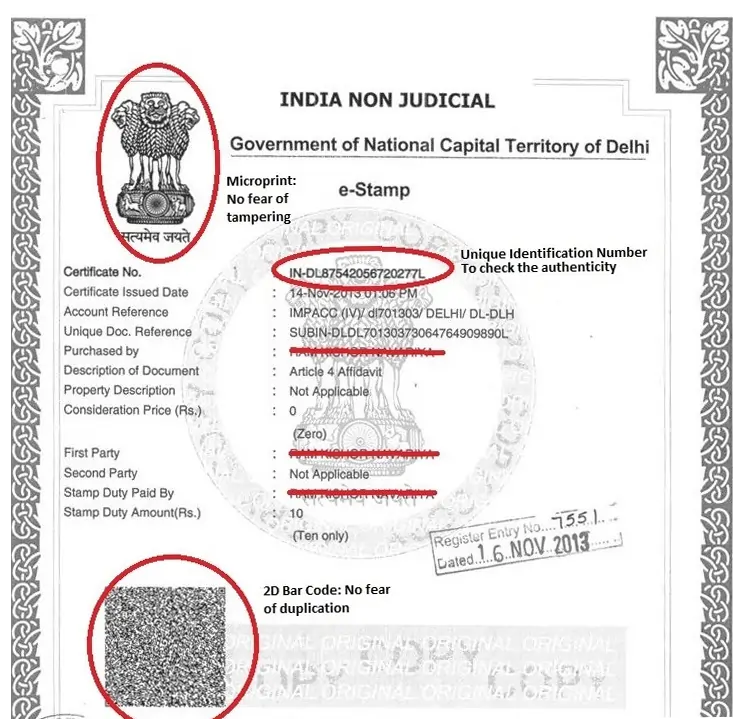

An e-Stamp is a secure, server-generated certificate that records:

- The exact date and time of payment

- The parties involved

- The purpose of the document

- A unique identification number (UIN)

Because it is generated digitally and stored in a central database, it Cannot be backdated, cannot be duplicated, cannot be reused & can be verified instantly

Your stamp duty payment is permanently linked to your agreement.

This guide provides clear, practical insights. You will learn the exact difference between stamp paper and e-Stamp paper, when to use each option, how to verify e-Stamps in seconds, and how to ensure your high-value agreements are legally secure.

Definitions: What These Terms Actually Mean?

What is Traditional (Physical) Stamp Paper?

This is the old-school Non-Judicial Stamp Paper you have seen for decades, green or pink papers with a revenue stamp printed at the top. You buy them from a licensed vendor (who often charges a premium in cash). The text of your agreement is typed directly onto this paper.

Risk: Once printed, typos cannot be fixed. If the vendor runs out of ₹100 papers, you are stuck buying two ₹50 papers or waiting.

What is Traditional (Green) Stamp Paper?

This is the physical paper you are likely familiar with, often green or pink, which looks like currency at the top. You buy it from a licensed vendor (stamp vendor).

The vendor writes your name in a register and hands over the paper. The text of your agreement is then typed or printed on the blank lower half.

Risk: Vendors often create artificial shortages to charge extra fees. Authenticity is hard to verify without.

What is E-Stamp (Digital Stamping)?

An E-Stamp is a computer-generated certificate. It looks like a standard A4 sheet with a secure QR code and a Unique Identification Number (UIN) printed on it.

You do not buy this from a shop; it is generated by a central server managed by the Stock Holding Corporation of India Limited (SHCIL) or state-specific bodies.

Benefit: The government records the transaction immediately. You can check if it is genuine on your phone in seconds

Traditional Stamp Papers vs. E-Stamp Paper

Feature | Traditional Stamp Paper (Non-Judicial) | E-Stamp Paper |

Authenticity | High risk of counterfeit, reused, or fake papers | 100% secure and verifiable online through UIN |

Availability | Depends on vendor stock; artificial shortages are common | Available 24/7; generated digitally |

Backdating | Possible through misuse by vendors | Impossible; date and time are server-locked |

Accessibility | Requires physical visit to vendor or court | Can be downloaded and printed from home or office |

Record Keeping | No central digital record | Stored centrally with SHCIL/CRA |

Legal Status | Valid, but being phased out in many states | Valid nationwide; mandatory in some states |

Speed | Slow due to physical procurement | Instant or near-instant |

Fraud Risk | High; prone to forgery and manipulation | Near zero; UIN locks data to one transaction |

Verification Cost Transparency | Manual and time-consuming Stamp duty plus possible illegal overcharging | Online verification in under a minute Stamp duty with a small, fixed convenience fee |

Registrar Acceptance | Accepted, but often scrutinized | Widely preferred due to easy verification |

Why E-Stamp Is Better for Legal Safety

E-Stamping removes the biggest risks associated with traditional stamp papers: fraud, delays, and verification problems.

Because every e-Stamp is digitally recorded, courts and registrars can instantly confirm:

- Who paid the stamp duty

- When it was paid

- For which purpose

- For which property or agreement

This makes e-Stamping the preferred choice for:

- Rent agreements

- Lease deeds

- Sale agreements

- Affidavits

- Loan documents

When Can Traditional Stamp Paper Still Be Used?

In limited situations, traditional stamp paper may still be used, such as:

- In remote areas with no digital access

- For specific legacy documentation

- Where local rules temporarily permit it

However, even in these cases, extra verification is recommended.

Quick Decision Box

Scan this to decide in 5 seconds.

If you need... | Use This... |

Speed & Safety (Rent, Affidavits, Business Contracts) | E-Stamp (via Digilawyer.ai ) |

Audit Trail (Corporate agreements, High-value loans) | E-Stamping (NeSL / E-Sign integrated) |

Remote Locations (Districts without internet/centres) | Traditional Stamp (Verify physical watermark) |

Backdated Agreements (To fix a past error) | Impossible. (Both are illegal to backdate. |

Who Needs E-Stamping? Use Cases & Real Benefits

E-Stamping reduces delays, paperwork errors, and legal risks. It is especially useful for people and businesses that regularly deal with agreements. Here is how it helps in real-life situations.

1. For Landlords and Small Business Owners

(Best for: Rental Agreements, Loan Agreements , Partnership Deeds)

If you sign a few contracts every month, your main problems are wasted time, unreliable vendors, and the risk of invalid documents.

How E-Stamp Helps

- Speed: You do not need to visit stamp vendors, banks, or courts. An e-Stamp can be generated online at any time, even outside office hours.

- Real-Life Example: A property owner in Mumbai who manages multiple rental flats earlier spent 2–3 days arranging cash and stamp papers. With e-Stamping, she now completes each agreement within 30–45 minutes.

- Better Dispute Protection: A physical stamp paper is only a paper, it can be questioned in court. An e-Stamp is backed by a digital record. Both parties can verify the UIN on the SHCIL portal and confirm who paid the duty and when. This reduces the chances of future disputes.

- Exact Payment (No Overcharging): Many vendors sell only fixed-value papers like ₹100 or ₹500, forcing you to overpay. With e-Stamping, you pay the exact required amount. If the duty is ₹650, you pay ₹650—no more, no less. Over time, this saves money and avoids unnecessary expenses.

2. For High-Volume Businesses

(Best for: HR Departments, Procurement Teams, Vendor Onboarding)

If your company handles hundreds of agreements, your biggest risks are poor record-keeping, audit issues, and internal fraud.

How E-Stamp Helps

- Audit Trail: Physical papers fade, tear, or get lost in filing cabinets. An E-Stamp creates a permanent digital footprint. If a tax officer or auditor asks for an agreement after five years, your team can retrieve it instantly without searching through storage rooms.

- Automation (No More Manual Entry): Many companies now connect e-Stamping directly with their contract life cycle management systems (CLM). When a manager approves a vendor agreement, the system automatically purchases the stamp and attaches it to the document. No one has to visit a shop or handle cash. Platforms like DigiSign from Digilawyer use API-based stamping to reduce manual errors and delays.

- Location Independence: You can generate a e-stamp for Delhi, Maharashtra, or Karnataka from any office in India. For example, a company headquartered in Bengaluru can execute a Delhi vendor agreement without sending a staff member to Delhi. This improves control and reduces dependence on local agents.

- Centralised Compliance: All stamping activity remains visible to the head office. This helps finance and legal teams monitor payments and prevent misuse.

How DigiLawyer Simplifies the Entire Process of Estamping in addition to Drafting to Delivery of Agreement

If you want a completely hassle-free experience, DigiLawyer manages the entire process for you, from preparing your agreement to e-Stamping and final delivery.

End-to-End Process

- Share Your Requirements: Provide your document details, parties’ information, and state.

- Professional Document Drafting (If Required) : Our legal team provides legal drafting services to prepare your agreement in line with applicable laws and your specific needs.

- Stamp Duty Calculation: We calculate the exact stamp duty based on your document type and state rules.

- E-Stamp Generation: We generate your official e-Stamp with a valid UIN through authorised channels.

- Document Integration: The e-Stamp is correctly attached to your drafted agreement.

- Digital Delivery: You receive the complete, ready-to-sign document by email within minutes.

- Optional Physical Shipping(If Required): We print and courier the stamped document to your address.

- Option E-signature or Aadhar Signature(If required): We assist with electronic signature solutions to ensure smooth and legally recognised execution.

Result

You get a legally compliant, correctly stamped, and professionally drafted document—without visiting vendors, banks, or government offices.

Conclusion

E-Stamping protects you from fraud. In 2026, relying on physical stamp vendors is an unnecessary risk.

Whether you are an individual, a landlord, or a business, using e-Stamp ensures that your documents remain legally valid and future-proof.

Do not leave high-value agreements to chance. Buy E-Stamp from Digilawyer, or let us manage the entire process for you.

FAQs

The ₹100 is the Government Tax (Stamp Duty), which goes 100% to the state treasury. The extra amount is a Service/Processing Fee covering the authorised vendor’s license costs, infrastructure, verification, and instant delivery.

Think of it this way: You are paying a small premium to save 4 hours of travel, queuing, and dealing with out-of-stock excuses at the local court.

No, they are separate products.

E-Stamp: Proof you paid the tax.

DSC/eSign: Proof you signed the document.

If you want to go fully digital, you need a platform. Digilawyer can do that. We will merge the E-Stamp with your PDF and then apply an Aadhaar eSign.

Strictly No. Unlike old physical papers, where vendors could manipulate dates, E-Stamps are generated with a real-time server timestamp.

You can mention in your agreement text that this agreement is effective from [Past Date], but the execution date (signing date) must be the stamp paper date or later. This is the only legal way to handle retrospective effect.

No. Once a Unique Identification Number (UIN) is generated, the data is permanently locked on the government server (SHCIL/CRA). It cannot be edited.

You must cancel the erroneous stamp (apply for a refund) and purchase a fresh one. Always double-check names against Aadhaar/PAN before clicking "Pay."

Technically, No; Practically, Yes. Under the Indian Stamp Act, the stamp paper itself does not have an expiry date. However, Section 54 allows for a refund only within 6 months of purchase.

Risk: If you present a 2-year-old unused stamp paper to a registrar, they may reject it or demand an explanation. It is best practice to use it within 6 months of purchase.

Generally, No. Stamp duty is a State Subject. You must buy the stamp paper for the state where the document is being executed or where the property is located.

Exception: Some specific commercial contracts allow for "Delhi-NCR" jurisdiction, but for property/rent, always buy the stamp of the specific state to avoid any issue.

Yes. E-Stamping only proves you paid the Tax. Notarization proves you signed it.

Step 1: Buy an E-Stamp (Pay Tax).

Step 2: Print Agreement.

Step 3: Sign.

Step 4: Notarise (Verify Signer).

E-Stamp does not replace the need for a Notary or Witnesses.

Usually, Yes. Franking (a red stamp machine impression) is an older method. Most modern banks now prefer E-Stamps because they can be verified online.

But firstly, ask your loan officer specifically: "Do you accept SHCIL E-Stamp Certificates with a UIN?" 99% will say yes, as it reduces their risk of holding fake documents.

It is invalid. The Registrar or Bank must be able to scan the QR or read the hex code.

Advice: Always print on a Laser Printer (High Quality). Do not use Draft Mode. If the QR and UIN are unreadable, the document is essentially a piece of waste paper until verified manually, which takes days.

Absolutely! Traditional stamp paper is still completely legal and works just fine for your business contracts. Whether you pick up stamp paper from a vendor or use e-stamping, both are equally valid in the eyes of the law.

Losing a Physical stamp paper document can be problematic as there's no straightforward recovery process. You'll likely need to purchase new stamp paper and recreate the entire document. To avoid this, always maintain certified photocopies, store originals securely, and keep digital scans as backup. This is one key advantage of e-stamping—digital records are easily backed up and retrieved.

Much faster! With e-stamping, you can get your stamp certificate in just a few minutes from your laptop or phone. No need to step out. Traditional stamping means finding a vendor, standing in line, and hoping they have the stamp value you need in stock. Plus, e-stamping works 24/7, even on weekends and holidays.

- Risks of Traditional Stamp & Why E-Stamp is Safer in 2026?

- Why E-Stamping Was Introduced

- Definitions: What These Terms Actually Mean?

- What is Traditional (Physical) Stamp Paper?

- What is Traditional (Green) Stamp Paper?

- What is E-Stamp (Digital Stamping)?

- Traditional Stamp Papers vs. E-Stamp Paper

- Why E-Stamp Is Better for Legal Safety

- When Can Traditional Stamp Paper Still Be Used?

- Quick Decision Box

- Who Needs E-Stamping? Use Cases & Real Benefits

- 1. For Landlords and Small Business Owners

- How E-Stamp Helps

- 2. For High-Volume Businesses

- How E-Stamp Helps

- How DigiLawyer Simplifies the Entire Process of Estamping in addition to Drafting to Delivery of Agreement

- End-to-End Process

- Result

- Conclusion

- FAQs